Indian cooperative credit societies play a vital role in the rural financial landscape, offering accessible credit and other financial services to members, often those marginalized by traditional banking systems. These societies, founded on principles of mutual aid and democratic control, offer a unique approach to financial inclusion and community development. They empower individuals and contribute significantly to the overall economic growth of rural India.

What is an Indian Cooperative Credit Society?

Cooperative credit societies in India are essentially member-owned and member-controlled financial institutions. They operate on the principle of “one member, one vote,” ensuring equitable participation in decision-making regardless of the member’s financial contribution. These societies primarily focus on providing credit to their members, particularly farmers and small business owners, at reasonable interest rates. They also offer other financial services like savings accounts, deposit schemes, and insurance. The societies are regulated by the state governments and the Reserve Bank of India, ensuring their stability and adherence to specific guidelines.

Types of Indian Cooperative Credit Societies

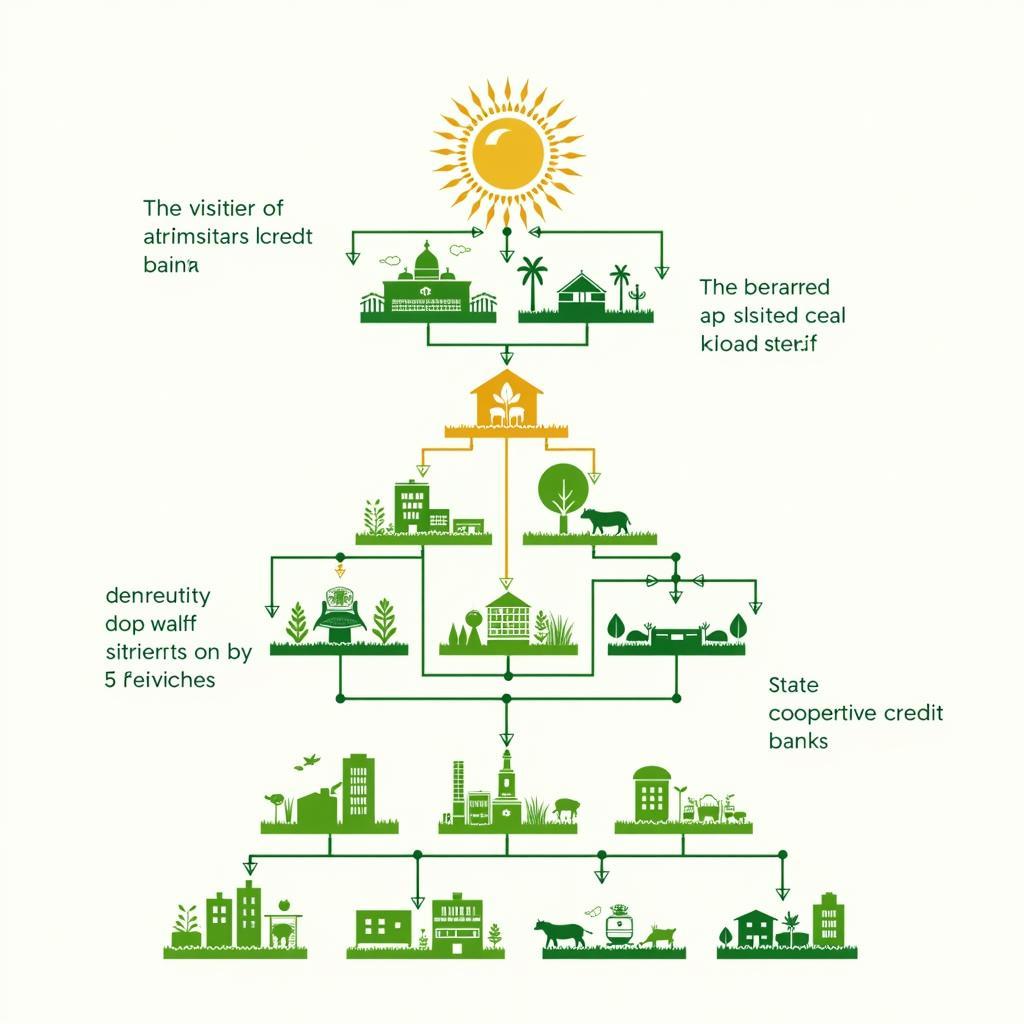

Indian cooperative credit societies are categorized into different tiers based on their structure and geographical reach. These include primary agricultural credit societies (PACS) at the village level, central cooperative banks at the district level, and state cooperative banks at the state level. This tiered structure facilitates the flow of funds and resources from the apex level down to the grassroots. It ensures efficient management and distribution of credit across different regions.

Indian Cooperative Credit Society Structure

Indian Cooperative Credit Society Structure

Benefits of Joining an Indian Cooperative Credit Society

Membership in an Indian Cooperative Credit Society offers numerous advantages, especially for individuals in rural areas. The most significant benefit is easy access to credit at affordable interest rates, often lower than those offered by commercial banks. These societies also promote savings habits among members, encouraging financial discipline and security. Moreover, members have a say in the society’s operations and governance, fostering a sense of ownership and community participation. Cooperative societies also provide financial literacy and education programs, empowering members to make informed financial decisions.

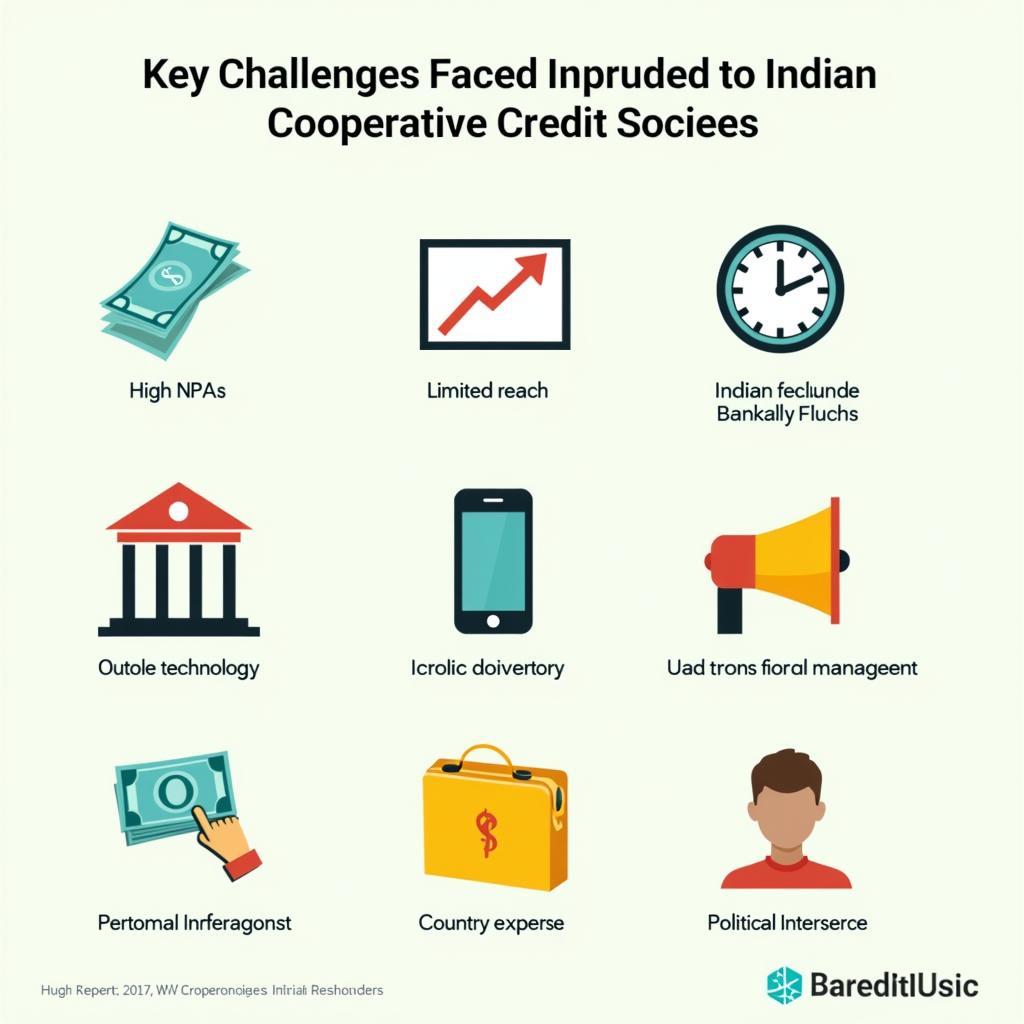

Challenges Faced by Indian Cooperative Credit Societies

Despite their significant contributions, Indian cooperative credit societies face several challenges. One of the primary concerns is the high level of non-performing assets (NPAs), which affects their financial health and sustainability. Another challenge is the limited reach of these societies in some areas, restricting access for certain populations. Moreover, outdated technology and infrastructure hinder efficient operations and service delivery. The lack of professional management expertise also poses a barrier to effective governance and growth. Finally, political interference sometimes disrupts the smooth functioning of these societies.

Challenges Faced by Indian Cooperative Credit Societies

Challenges Faced by Indian Cooperative Credit Societies

The Future of Indian Cooperative Credit Societies

The Indian government has taken several initiatives to strengthen and revitalize the cooperative credit sector. These include reforms aimed at improving governance, enhancing financial health, and promoting technological adoption. The focus is on leveraging technology to improve efficiency, transparency, and accessibility of services. Furthermore, efforts are being made to expand the reach of these societies to underserved areas, ensuring greater financial inclusion.

How can technology improve Indian cooperative credit societies?

Technology can streamline operations, enhance transparency, and improve accessibility for members. Mobile banking, online loan applications, and digital record-keeping are just a few examples of how technology can revolutionize the functioning of these societies.

What is the role of the government in supporting these societies?

The government plays a crucial role in providing regulatory oversight, implementing reforms, and offering financial support to ensure the stability and growth of cooperative credit societies.

Future of Indian Cooperative Credit Societies

Future of Indian Cooperative Credit Societies

Conclusion

Indian cooperative credit societies remain a vital component of the Indian financial system, particularly in rural areas. They empower individuals, promote financial inclusion, and contribute to economic development. Addressing the challenges and embracing technological advancements will further strengthen these institutions, allowing them to continue playing their crucial role in empowering communities and fostering economic growth. The Indian cooperative credit society continues to offer hope and opportunity for a more financially inclusive future.

FAQ

- What is the main purpose of an Indian cooperative credit society? To provide affordable credit and other financial services to its members, primarily in rural areas.

- Who regulates these societies? State governments and the Reserve Bank of India.

- What are the benefits of joining a cooperative credit society? Access to affordable credit, savings opportunities, and participation in governance.

- What are some of the challenges faced by these societies? High NPAs, limited reach, and outdated technology.

- How can technology improve these societies? By streamlining operations, enhancing transparency, and improving accessibility.

- What is the role of the government in supporting these societies? Providing regulatory oversight, implementing reforms, and offering financial support.

- What is the future of Indian cooperative credit societies? Continued growth and adaptation through technological advancements and government support.

Looking for more information? Explore related articles on our website about financial inclusion, microfinance, and rural development. When you need support, please contact us at Phone: 02043854663, Email: [email protected] or visit us at Zone 34, Bac Giang, 260000, Vietnam. We have a 24/7 customer service team.